|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding House Appraisal for Refinance: A Comprehensive GuideRefinancing your home can be an excellent way to secure a better interest rate or adjust the terms of your mortgage. However, a crucial step in this process is the house appraisal. This guide will help you understand the ins and outs of house appraisals when refinancing. What is a House Appraisal?A house appraisal is a professional assessment of a property's market value. Conducted by a licensed appraiser, it provides an unbiased evaluation based on various factors such as location, condition, and recent sales of similar properties. Why is an Appraisal Important for Refinancing?The appraisal plays a critical role in refinancing as it determines how much a lender is willing to lend you. A higher appraised value can offer better refinancing options. Impact on Loan-to-Value RatioThe loan-to-value (LTV) ratio is crucial in determining the terms of your refinance. A lower LTV can lead to more favorable loan terms. Ensuring a Fair Market ValueAppraisals ensure that the property is valued at its current market worth, protecting both the borrower and the lender. Preparing for a House AppraisalTo maximize your appraisal value, consider the following steps:

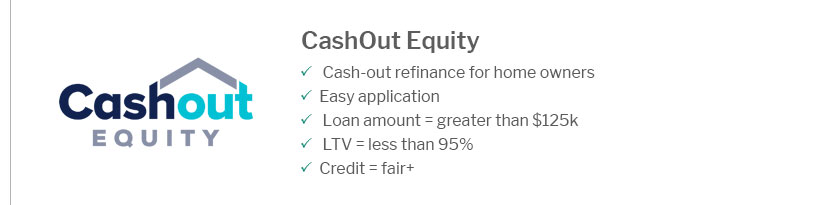

Choosing the Right Refinance OptionOnce you have your appraisal, it's time to select a refinancing option that fits your needs. Consider exploring the top 5 refinance mortgage companies to find the best rates and terms available. Common Appraisal Issues and SolutionsSometimes, appraisals come in lower than expected. Here's what you can do:

FAQs about House Appraisal for Refinance

Refinancing your mortgage is a significant financial decision. To ensure the best outcomes, understanding the appraisal process is essential. If you're looking for the best refinancing options, consider checking out the top banks to refinance mortgages for competitive rates and terms. https://www.businessinsider.com/personal-finance/mortgages/what-is-home-appraisal

Mortgage lenders will always require an appraisal before they'll agree to loan money for a property. They want to be sure the home is worth what ... https://www.veteransunited.com/valoans/how-lenders-can-approach-appraisals-and-va-refinance-loans/

An appraisal for a refinance serves a slightly different purpose. While it determines the property's current market value, it also evaluates how ... https://www.reddit.com/r/Mortgages/comments/1f3u8md/do_i_need_a_new_appraisal_for_refi/

Depends on the value and your credit worthiness. Some lenders only do a drive-by if you have enough equity in the house and they're just ...

|

|---|